Why Is Trade Finance Needed for Solopreneurs and Microenterprises?

And Why It Benefits Solopreneurs and Microentrepreneurs Looking For It 🌎

In an international trade transaction, you always need to make sure that you have the necessary funds to complete it. In some cases, you do not have the full amount of money needed to buy the goods upfront. Or as a seller or exporter, you need to pay for the production of the goods before you export them. Your business needs cash to fulfill orders. And also maintain cash flow during the international trade process. In this case, your counterparty (i.e. buyer) could potentially not pay you in the end.

In other instances, you also protect your trade against exchange rate risks. Some events in your destination country such as political turmoils are risks too. You also have many other costs associated with the international trade of goods. Such as transportation, customs fees, tariffs, and other export/import expenses.

For all these reasons, you need financing for your international trade. In short, you and your counterparty need this. Because you need exports- or you need imports for your local business. There are many benefits of exporting for solopreneurs and microentrepreneurs.

What are the benefits of exporting?

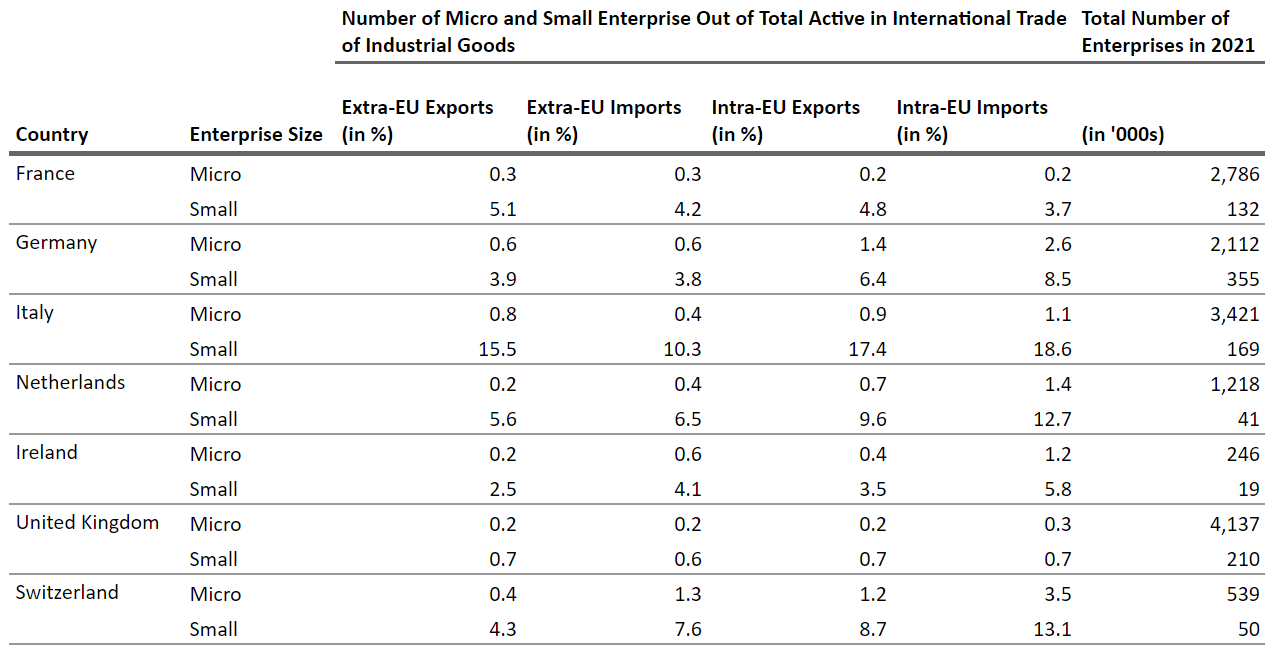

World-wide, less than two per cent of the total number of companies are exporting. For example, the United States is the world’s second-largest exporter. Yet, less than one percent of its 32 million companies export. Small and medium enterprises are less likely to export to more than one market. Similar proportions apply to the top exporting countries in Europe too. As you can see in the table below.

As discussed in a previous article, 90 to 99% of the world’s consumers live outside of your local market. If you start to export or expand to more markets then you:

increase your sales

diversify your client base

protect yourself against economic downturns in your home base

access new financing routes- which in turn can lead to more trade i.e. sales

If you need to finance your international trade business then how do you do it? There are several ways to finance it with traditional providers of trade finance. Yet, not every usual trade finance provider services well aspiring or experienced entrepreneurs. Whether you own a company startup or a mature one.

Stay tuned for the next article which will list these providers as well as other sources for funding your international trade business.

Bob's Jargon Buster

Nothing to report today

The Memes Bazaar & Funny Tweets

I did not see any intersting memes or funny tweets

What Do You Think About Today’s Issue?

I currently conduct a series of interviews with solopreneurs in international trade. If you are one, I would love to know what you do and how you do it. Whether you use trade finance or not. And if we both agree about it, your story will feature in this space here (it is free). Email me back about your availability for an interview.

That is all for today folks. Stay hungry and see you next time! Hit me up on my Twitter (@finbzr) if you need anything. You can also fill out this survey in less than 59 seconds to tell me what you think about this article.

Disclaimer: I recently got started so let us see where this is going- and whether it needs a disclaimer!